WPRO News

Rhode Island state officials scrambled on Monday to help residents who depend on a variety of public benefit systems, which came under attack by hackers demanding ransom from the state vendor, Deloitte. State Police were called in to investigate.

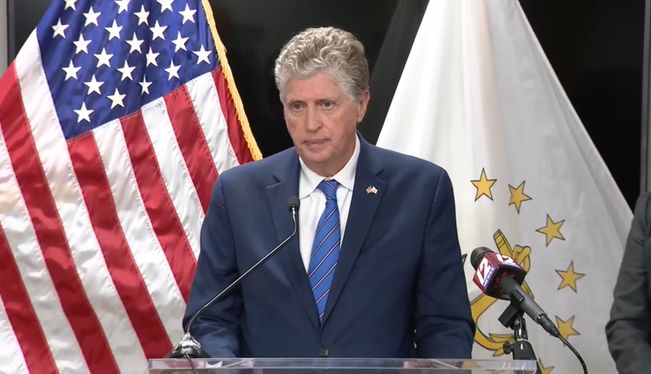

The “RIBridges” system, formerly known as UHip was proactively shut down abruptly Friday after officials learned of the threat, said Governor Dan McKee, in a hastily-called Friday news conference.

Deloitte indicated to the state that the compromised information may include names, addresses, dates of birth and Social Security numbers, as well as certain banking information.

At subsequent briefings, officials announced the RIBridges system would be suspended, and that customers would not be able to log in and that paper applications would be accepted. Some people lined up Monday outside a state Department of Health and Human Services office in Providence to make applications.

The state and Deloitte announced a telephone hotline began operations Monday to answer questions at 833-918-6603.

An online website to provide updates and further information was established at: https://admin.ri.gov/ribridges-alert

The state indicated that those who’s personal information has been compromised would receive a letter by mail from the state explaining how to access free credit monitoring.

The RIBridges system supports a number of state programs, including:

Medicaid

Supplemental Nutrition Assistance Program (SNAP)

Temporary Assistance for Needy Families (TANF)

Child Care Assistance Program (CCAP)

Health coverage purchased through HealthSource RI

Rhode Island Works (RIW)

Long-Term Services and Supports (LTSS)

General Public Assistance (GPA) Program

In an advisory, the state advised that those who receive state services:

1: Freeze Your Credit

Reach out to all three credit reporting agencies to freeze your credit. This is free and means no one else can take out a loan or establish credit in your name. You won’t lose access to your money or credit cards. You can lift the freeze at any time.

2: Monitor Your Credit

Contact one of the three credit reporting agencies to order a free credit report. You can also access a free credit report through AnnualCreditReport.com.

3: Request a Fraud Alert

Ask one of the credit reporting agencies to place a fraud alert on your files. This is free and lets creditors know to contact you before any new accounts can be opened in your name. Asking one agency to do this will cover this step for all three agencies.

4 Use Multifactor Authentication

This means instead of having just one password to access your information, you have a safety backup to help prove that it’s really you before you can log into your account.

5 Be Aware

Because of the breach, you may receive fake emails, phone calls or texts that look legitimate. Remember, never share personal information – such as your social security number, date of birth or password – through an unsolicited e-mail, call or text.